Good afternoon, this is Tilkoblet Singapore.

There has been an explosion in inquiries from companies recently preparing or considering establishing a corporation in Singapore.

With increasing concerns about the economic outlook in China and sudden declines in the Hong Kong economy, many companies are contemplating to relocate from Hong Kong to Singapore.

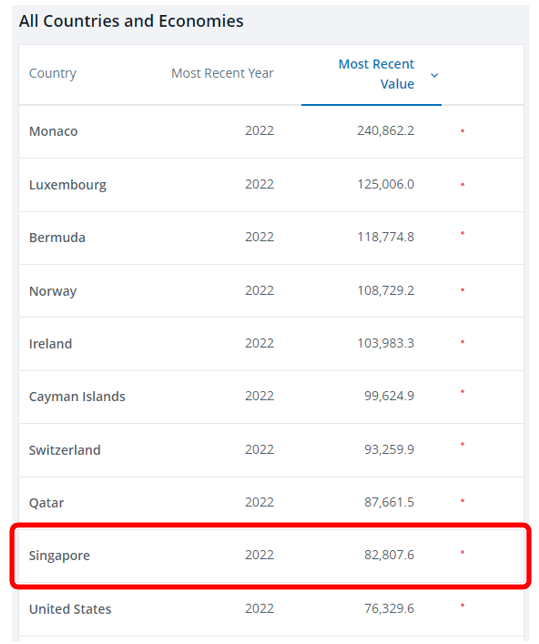

Singapore’s per capita GDP hit USD 82,807 in 2022, positioning it as one of the affluent nations within the top nine globally.

Considering that the global average is USD 12,687, there is a significant difference. Furthermore, Singapore hosts many regional headquarters of global companies for the Asia-Pacific Region.

Just by looking at the numbers, Singapore does have a strong image of being a well-managed country with stable politics and economy, alongside with cleanliness and minimal corruption. However, living in Singapore often reveals that there are things happening somewhat differently from the image projected externally.

If you wish to establish a company in Singapore, you will need to appoint a Corporate Secretarial (Corp-Sec) firm to handle the initial setup and ongoing management.

These Corp-Sec firms will appoint a secretary to your company, manage director registrations, share administration, and handle accounting and financial reporting (in collaboration with an Accounting Firm). They will also take care of various matters needed for the Annual General Meeting (AGM) held annually after the financial year end.

Currently, there are approximately 2,700 Corp-Sec firms in Singapore, managing not only the yearly influx of 60,000 newly registered companies but also more than 500,000 existing companies. The issue lies in the inherent nature of these Corp-Sec firms, which, due to the nature of their work, inevitably have access to internal information of companies.

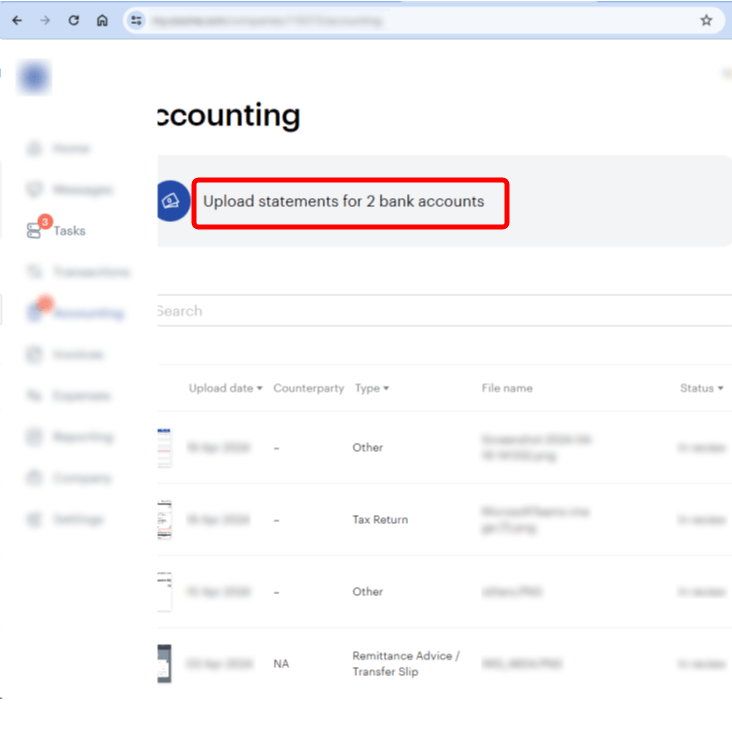

From various contracts and invoices, to sensitive information like credit card transaction statements and bank statements, there’s no avoiding the transmission of such data. The question is, do Singaporean Corp-Sec firms truly manage this information well? Below is the internet screen provided by a local Singaporean Corp-Sec for uploading bank transaction statements for accounting purposes. (Please note that mentioning structural flaws of Singaporean Corp-Sec firms is not indicative of the company being discussed in this post. This is merely a sample screen capture unrelated to the topic of this post.)

When you send bank statements or hard copies of bank statements issued by banks or credit card companies to a Corp-Sec firm, they have to manually input the numbers from those documents into their computer systems one by one. Of course, some places might use automated software like OCR. However, Singaporean Corp-Sec firms tend to prefer manual data entry because even a single incorrect entry could cause significant issues.

But here’s the thing. With Singaporean workers, whose per capita income ranks among the top nine globally engaging in such manual data entry, one may wonder how much it costs to operate or manage a company in Singapore. Recently, with companies flooding in from Hong Kong, it seems that the Singaporean Corp-Sec market has also entered a phase of overheated competition.

Corp-Sec firms offering to establish a corporation and provide management within a day for an annual fee of just $999 are popping up left and right. But can they truly afford to employ Singaporean workers, with an average annual salary of USD 82,807, and handle the processing of numerous receipts and bank statements for such a low cost?

To survive amidst the overheated competition, Singaporean Corp-Sec firms have opted for outsourcing to neighboring countries like Malaysia and Indonesia, where labour costs are relatively lower. Indonesia has a per capita income of approximately USD 4,788 as of 2022, while Malaysia’s is around USD 11,993. They also have plenty of skilled personnel capable of communicating in English. Moreover, with a significant population of Chinese Malaysians, communication in Mandarin is also feasible between Malaysia and Singapore.

Many workers commute between Malaysia and Singapore daily as they share a common living area. Therefore, documents delivered in hard copy can be forwarded to Malaysia on the same day. The issue arises when documents are transmitted online or offline and flow into developing countries like Indonesia and Malaysia, where they must be accessed for data entry, leaving them vulnerable during inspection.

For Corp-Sec firms utilizing Tilkoblet Singapore’s DTT (Digital Transformation Solution), there is no manual data entry involved. DTT directly receives data from transaction banks and automatically generates transaction records without any human intervention, ensuring 100% automation.

Data stored in the secure database is strictly prohibited from being accessed by anyone other than authorized administrators with specific permissions. Furthermore, any actions such as saving as PDF or downloading data are closely monitored, ensuring a high level of security.

If you are considering establishing a corporation in Singapore and aiming for global expansion, it seems imperative to ensure that the Corp-Sec you’re seeking assistance from is utilizing Tilkoblet’s DTT solution.

https://dtt.sg

help@tilko.sg

Tilkoblet Pte. Ltd.

9 Straits View, #05-07 Marina One West Tower, Singapore 018937